All Categories

Featured

Table of Contents

- – What Are The Most Effective Learning Formats F...

- – How Can I Maximize My Learning In Financial Re...

- – What Are The Highest Rated Courses For Asset ...

- – What Are The Most Comprehensive Resources For...

- – What Is The Most Important Thing To Know Abo...

- – Who Offers The Leading Training For Real Est...

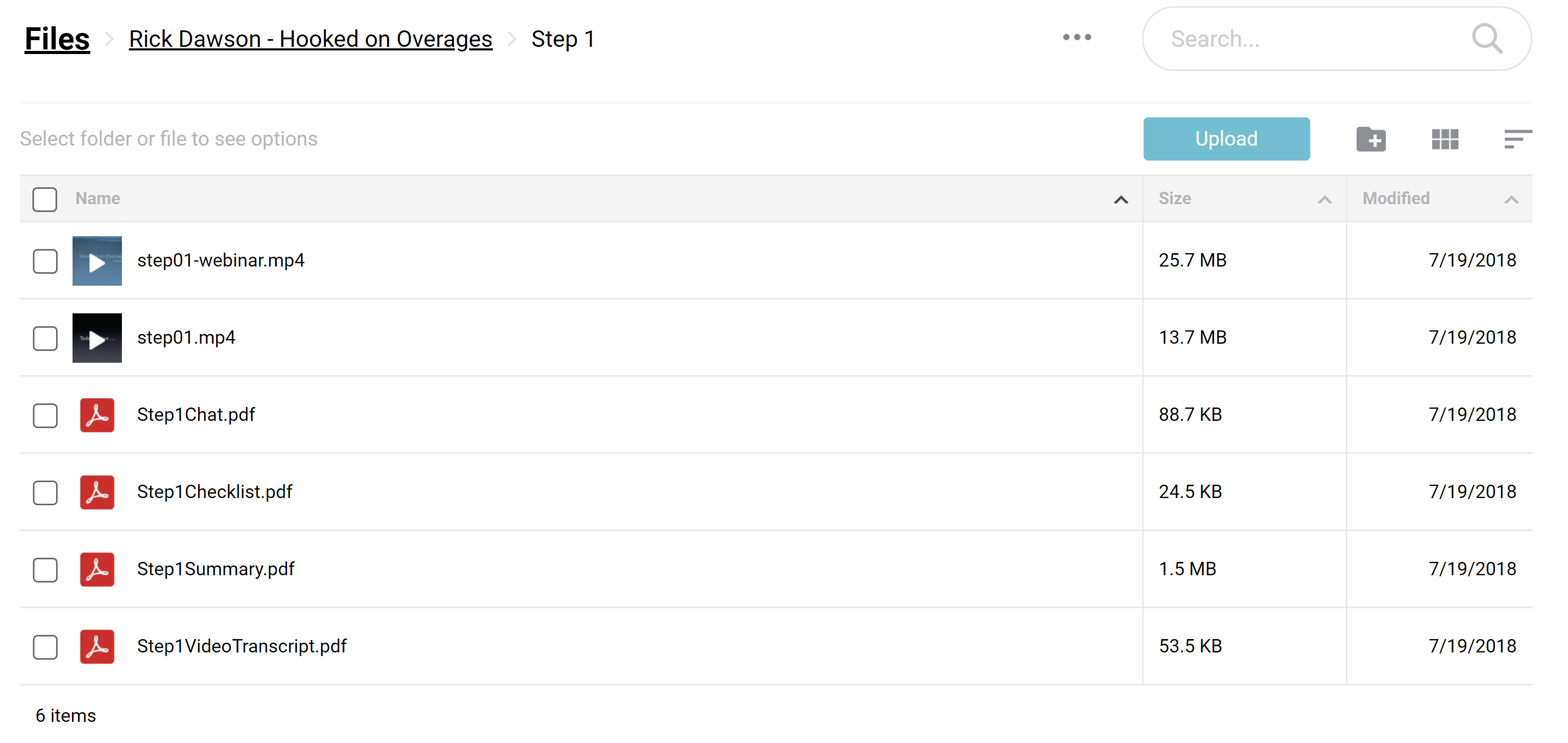

Any kind of remaining excess comes from the proprietor of record immediately prior to completion of the redemption period to be declared or appointed according to regulation - recovery. These amounts are payable ninety days after execution of the act unless a judicial activity is instituted during that time by another complaintant. If neither asserted nor appointed within 5 years of day of public auction tax sale, the excess will escheat to the general fund of the regulating body

386, Sections 44, 49.C, eff June 14, 2006. Code Commissioner's Note 1997 Act No. 34, Area 1, directed the Code Commissioner to transform all referrals to "Register of Mesne Conveyances" to "Register of Deeds" wherever showing up in the 1976 Code of Regulations.

What Are The Most Effective Learning Formats For Investor Tools?

201, Component II, Area 49; 1993 Act No. 181, Section 231. The stipulations of Sections 12-49-1110 via 12-49-1290, inclusive, relating to observe to mortgagees of proposed tax obligation sales and of tax sales of residential or commercial properties covered by their respective home loans are adopted as a part of this phase.

Official may void tax sales. If the authorities in charge of the tax sale discovers prior to a tax obligation title has passed that there is a failure of any kind of action required to be effectively executed, the authorities may void the tax obligation sale and refund the quantity paid, plus interest in the quantity really earned by the area on the amount reimbursed, to the successful prospective buyer.

BACKGROUND: 1962 Code Area 65-2815.14; 1971 (57) 499; 1985 Act No. 166, Section 14; 2006 Act No. 386, Sections 35, 49. D, eff June 14, 2006. Code Commissioner's Note At the instructions of the Code Commissioner, the initial sentence as amended by Section 49. D of the 2006 modification is stated above.

Agreement with area for collection of tax obligations due town. A region and community may get for the collection of community tax obligations by the county.

How Can I Maximize My Learning In Financial Resources Training?

He may utilize, designate, or mark others to carry out or lug out the provisions of the chapter. BACKGROUND: 1962 Code Area 65-2815.16; 1971 (57) 499; 1985 Act No. 166, Section 16.

Tax obligation liens and tax deeds usually sell for greater than the area's asking rate at public auctions. In enhancement, a lot of states have legislations impacting bids that exceed the opening proposal. Settlements above the county's criteria are recognized as tax obligation sale excess and can be rewarding investments. However, the information on overages can produce problems if you aren't familiar with them.

In this write-up we inform you how to obtain lists of tax obligation overages and earn money on these assets. Tax obligation sale overages, also referred to as excess funds or premium proposals, are the quantities bid over the beginning rate at a tax obligation auction. The term describes the dollars the capitalist spends when bidding process over the opening bid.

What Are The Highest Rated Courses For Asset Recovery Training?

The $40,000 increase over the original bid is the tax obligation sale excess. Claiming tax obligation sale excess implies acquiring the excess cash paid throughout an auction.

That stated, tax sale overage insurance claims have actually shared qualities throughout the majority of states. Throughout this duration, previous owners and home mortgage owners can get in touch with the region and get the excess.

What Are The Most Comprehensive Resources For Learning Financial Guide?

If the duration runs out before any type of interested events declare the tax sale overage, the region or state typically soaks up the funds. As soon as the cash mosts likely to the federal government, the possibility of asserting it disappears. Previous proprietors are on a stringent timeline to case overages on their residential properties. While excess typically do not correspond to higher profits, financiers can benefit from them in several means.

Remember, your state laws influence tax sale overages, so your state could not allow financiers to gather overage passion, such as Colorado. However, in states like Texas and Georgia, you'll earn interest on your whole quote. While this facet does not imply you can assert the excess, it does aid mitigate your expenses when you bid high.

Keep in mind, it could not be lawful in your state, indicating you're restricted to gathering rate of interest on the excess - opportunity finder. As mentioned above, an investor can locate ways to benefit from tax sale overages. Since rate of interest revenue can put on your whole proposal and previous proprietors can assert overages, you can leverage your expertise and tools in these scenarios to make the most of returns

As with any kind of financial investment, study is the essential opening action. Your due diligence will certainly give the necessary insight into the homes offered at the next auction. Whether you use Tax Sale Resources for financial investment data or call your area for details, a detailed examination of each building lets you see which residential properties fit your investment version. A critical element to bear in mind with tax obligation sale excess is that in most states, you only require to pay the area 20% of your overall quote up front., have laws that go beyond this regulation, so once more, research study your state regulations.

What Is The Most Important Thing To Know About Overages?

Instead, you only need 20% of the proposal. Nevertheless, if the home does not redeem at the end of the redemption duration, you'll need the staying 80% to obtain the tax deed. Since you pay 20% of your proposal, you can gain interest on an excess without paying the complete price.

Once again, if it's lawful in your state and area, you can function with them to assist them recover overage funds for an additional cost. You can collect rate of interest on an overage quote and bill a fee to streamline the overage insurance claim procedure for the previous proprietor.

Overage collectors can filter by state, region, residential or commercial property kind, minimum overage quantity, and maximum excess amount. Once the information has actually been filteringed system the enthusiasts can determine if they wish to add the avoid mapped information plan to their leads, and after that spend for just the verified leads that were discovered.

Who Offers The Leading Training For Real Estate Claims?

To begin with this video game altering item, you can find out more here. The ideal means to obtain tax obligation sale overage leads Concentrating on tax obligation sale overages rather than traditional tax obligation lien and tax deed spending requires a details strategy. Furthermore, much like any type of other investment strategy, it provides one-of-a-kind advantages and disadvantages.

Table of Contents

- – What Are The Most Effective Learning Formats F...

- – How Can I Maximize My Learning In Financial Re...

- – What Are The Highest Rated Courses For Asset ...

- – What Are The Most Comprehensive Resources For...

- – What Is The Most Important Thing To Know Abo...

- – Who Offers The Leading Training For Real Est...

Latest Posts

Property Tax Deed

Government Tax Foreclosure Auction

Tax Liens Investing Reddit

More

Latest Posts

Property Tax Deed

Government Tax Foreclosure Auction

Tax Liens Investing Reddit