All Categories

Featured

Table of Contents

Regardless of being certified, all financiers still require to perform their due persistance throughout the procedure of investing. Certified capitalists can access our option of vetted investment possibilities.

With over $1.1 billion in protections offered, the monitoring team at 1031 Crowdfunding has experience with a variety of financial investment frameworks. To access our total offerings, register for an investor account.

Accredited's workplace society has actually often been Our company believe in leaning in to sustain enhancing the lives of our coworkers similarly we ask each various other to lean in to passionately support enhancing the lives of our clients and area. We offer by providing ways for our group to remainder and re-energize.

Exclusive Accredited Investor Income Opportunities Near Me – Fort Worth TX

We also offer up to Our magnificently designated building includes a physical fitness room, Relax & Relaxation spaces, and technology designed to sustain adaptable work spaces. Our finest concepts originate from teaming up with each various other, whether in the office or working remotely. Our proactive investments in technology have actually enabled us to create an enabling staff to add anywhere they are.

If you have an interest and feel you would certainly be an excellent fit, we would love to attach. Please ask at.

High-Quality Secure Investments For Accredited Investors Near Me (Fort Worth 76101 TX)

Recognized financiers (sometimes called professional capitalists) have accessibility to financial investments that aren't readily available to the public. These investments can be hedge funds, tough cash financings, exchangeable investments, or any kind of various other safety that isn't signed up with the financial authorities. In this write-up, we're going to focus especially on real estate investment choices for recognized financiers.

This is whatever you require to learn about realty spending for accredited investors (private investments for accredited investors). While anyone can purchase well-regulated protections like stocks, bonds, treasury notes, shared funds, and so on, the SEC is worried concerning average capitalists getting involved in financial investments beyond their means or understanding. So, instead of permitting any individual to spend in anything, the SEC produced a certified investor requirement.

It's essential to keep in mind that SEC laws for certified capitalists are made to secure investors. Without oversight from monetary regulatory authorities, the SEC simply can not review the threat and reward of these investments, so they can not give information to enlighten the average financier.

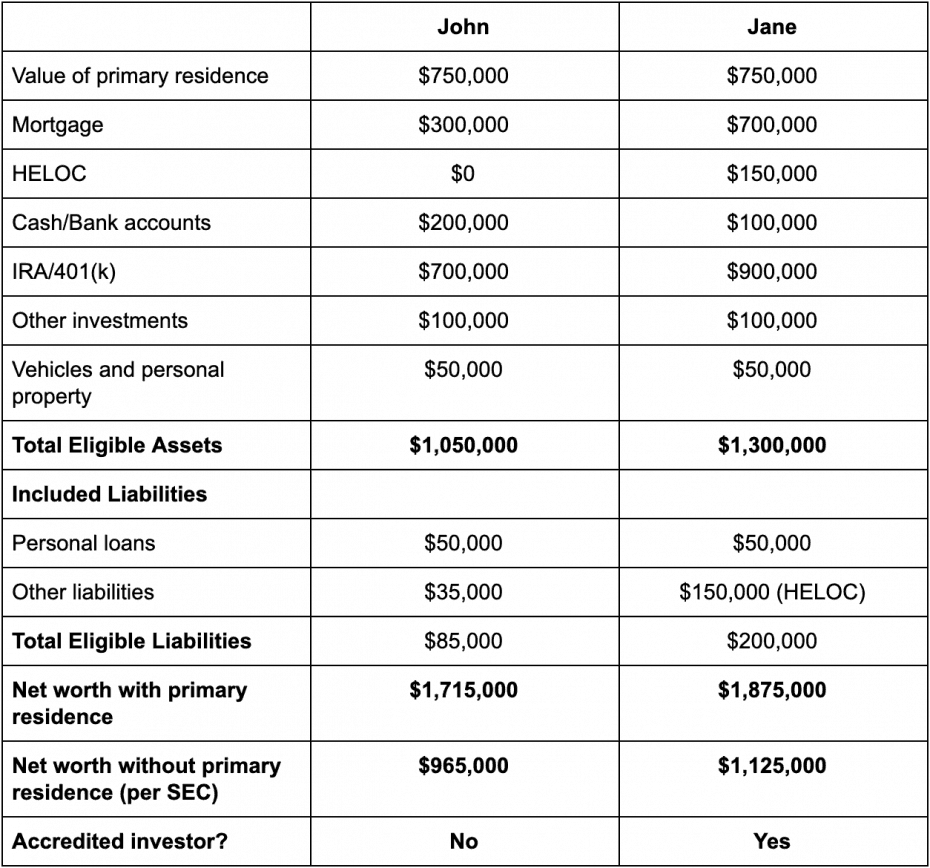

The idea is that investors who gain sufficient income or have adequate wealth are able to take in the threat better than capitalists with reduced revenue or less wealth. As a recognized investor, you are anticipated to finish your very own due diligence prior to including any kind of asset to your investment portfolio. As long as you meet one of the adhering to four requirements, you certify as a recognized capitalist: You have gained $200,000 or more in gross earnings as a specific, annually, for the previous 2 years.

Professional Investment Opportunities For Accredited Investors

You and your partner have had a mixed gross revenue of $300,000 or more, each year, for the past two years (crowdfunding sites for accredited investors). And you expect this level of earnings to continue.

Or all equity proprietors in the service certify as certified investors. Being a certified capitalist opens up doors to investment possibilities that you can't access otherwise.

Expert Returns For Accredited Investors Near Me – Fort Worth 76101 TX

Coming to be a certified capitalist is simply an issue of confirming that you meet the SEC's needs. To validate your revenue, you can provide paperwork like: Tax return for the previous 2 years, Pay stubs for the previous 2 years, or W2s for the previous two years. To verify your total assets, you can provide your account statements for all your properties and liabilities, consisting of: Savings and inspecting accounts, Investment accounts, Impressive fundings, And property holdings.

You can have your attorney or CPA draft a verification letter, confirming that they have actually evaluated your financials and that you meet the requirements for an approved capitalist. It might be much more cost-effective to utilize a service especially made to verify certified financier statuses, such as EarlyIQ or .

Affordable Returns For Accredited Investors Near Me – Fort Worth 76101 TX

For instance, if you join the property investment company, Gatsby Financial investment, your recognized financier application will certainly be processed via VerifyInvestor.com at no cost to you. The terms angel investors, innovative financiers, and approved capitalists are often utilized mutually, but there are refined distinctions. Angel investors give venture capital for start-ups and small companies in exchange for possession equity in business.

Usually, any person that is approved is presumed to be an advanced investor. The income/net worth requirements continue to be the same for international capitalists.

Below are the best financial investment possibilities for recognized investors in genuine estate.

Some crowdfunded genuine estate investments don't call for accreditation, but the tasks with the best possible incentives are normally scheduled for accredited financiers. The difference in between jobs that approve non-accredited investors and those that only approve accredited financiers generally boils down to the minimal investment quantity. The SEC currently limits non-accredited investors, that make much less than $107,000 annually) to $2,200 (or 5% of your annual earnings or total assets, whichever is much less, if that amount is even more than $2,200) of financial investment funding each year.

Table of Contents

Latest Posts

Property Tax Deed

Government Tax Foreclosure Auction

Tax Liens Investing Reddit

More

Latest Posts

Property Tax Deed

Government Tax Foreclosure Auction

Tax Liens Investing Reddit